Trade Tensions Shake Global Markets

Global stock markets faced a major downturn after new tariff threats from U.S. President Donald Trump triggered panic among investors. Uncertainty surrounding the ongoing trade war between the United States and China has rattled financial markets worldwide.

Trump’s warning of a potential 50% tariff on Chinese goods added to growing fears of a global economic slowdown, causing wild swings in market performance.

U.S. Stock Markets Experience Sharp Decline

After a brief recovery early in the day, U.S. stocks reversed course and dropped significantly by Monday’s close.

Key figures:

Dow Jones Industrial Average: Fell 800 points (around 2%)

S&P 500 Index: Declined 1.7%

Nasdaq Composite: Dropped 1.3%

Markets opened with steep losses, briefly bounced back, and then fell again as investors tried to make sense of mixed messages from the U.S. government.

“There’s an immense amount of volatility at the moment amid an immense amount of uncertainty,” said Bret Kenwell, investment analyst at eToro (Source: ABC News).

Trump’s Tariff Moves Explained

President Trump’s recent comments on Truth Social suggested a hardline approach towards trade negotiations.

The U.S. recently imposed a 34% tariff on Chinese goods, on top of an earlier 20% tariff.

In response, China announced 34% retaliatory tariffs.

Trump now threatens to add another 50%, bringing total U.S. tariffs on Chinese imports to a staggering 104%.

“Countries from all over the world are talking to us,” Trump claimed. “Tough but fair parameters are being set.”

These back-and-forth moves have created confusion and concern over the future of global trade.

Experts Warn of Broader Impact

Analysts warn that these tariff escalations could have long-term effects on the economy.

Slower global economic growth

Higher inflation

Delays in Federal Reserve decisions

“You can draw a line from these tariffs to slower growth and rising inflation,” noted Ivan Feinseth from Tigress Financial. “Now everything is in a panic.”

Investors are eager for any signs of a resolution. Even brief news of possible negotiations gave markets a temporary lift.

Cryptocurrencies Also Take a Hit

The downturn wasn’t limited to traditional stock markets. Cryptocurrencies also suffered losses.

Key losses:

Bitcoin: Dropped 0.9%, now around $79,000 (down 30% from January highs)

Ether (ETH): Fell 3.4%

Solana (SOL): Decreased 1.1%

Asian Markets See Worst Day Since 2008

Asia’s stock markets were among the hardest hit. Sharp falls were reported across the region, with Hong Kong experiencing a historic crash.

Major losses:

Hang Seng Index (Hong Kong): Down 13.22% – worst since 1997

Nikkei 225 (Tokyo): Dropped nearly 9%

Taiex (Taiwan): Fell 9.7%

KOSPI (South Korea): Lost 5.5%

S&P/ASX 200 (Australia): Fell 6%, later recovered slightly

Shanghai Composite (China): Dropped 7% despite government support

BSE Sensex (India): Down 5.19%

Nifty 50 (India): Dropped 5%

This marked the worst day of trading for Asian markets since the 2008 global financial crisis.

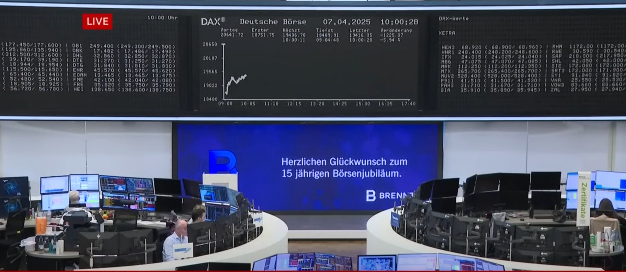

European Markets Join Global Sell-off

European stock markets opened with major losses on Monday morning.

European market performance:

FTSE 100 (UK): Dropped 6%

Stoxx 600 (pan-European): Fell more than 6%

DAX (Germany): Slid 10%

CAC 40 (France): Lost 6.6%

FTSE MIB (Italy): Declined 5.7%

U.S. Faces More Losses

Investors in the U.S. prepared for more losses following Trump’s declaration of “Liberation Day” tariffs last week.

Speaking from Air Force One, Trump addressed concerns about market crashes and potential recession fears:

“Sometimes you have to take medicine to fix something,” Trump said. “We’ve been treated badly by other countries… but our country is getting stronger.”

Despite his reassurances, Friday’s trading session marked the worst day for U.S. stocks since 2020.

Friday’s performance:

Dow Jones: Lost 2,230 points (5.5%)

S&P 500: Dropped 6%

Nasdaq: Fell 5.8% – entering bear market territory

Summary: What This Means for Investors

The global markets are currently riding a wave of uncertainty driven by escalating trade tensions, especially between the U.S. and China. With talks still unclear and new tariffs on the horizon, investors are bracing for more turbulence in the coming weeks.

Key takeaways:

Trade wars are directly impacting global financial stability

Stock markets and cryptocurrencies are experiencing high volatility

Analysts warn of long-term economic effects if tensions continue

Investors are hoping for diplomatic solutions to avoid further damage

Sources:

ABC News: Market Volatility Due to Tariffs

Bloomberg & Reuters: Financial market insights

Truth Social: President Trump’s statements

MarketWatch, CNBC: Stock performance data